We all know it’s sometimes hard to make ends meet even when we are living as a couple. It can get harder when living as a separated dad as it is more expensive living as a single. Not only are you now paying all your living expenses on your own but you most probably have additional expenses in way of child support and assistance for your children and/ or just the added expense of caring for the children whilst in your care.

We all know it’s sometimes hard to make ends meet even when we are living as a couple. It can get harder when living as a separated dad as it is more expensive living as a single. Not only are you now paying all your living expenses on your own but you most probably have additional expenses in way of child support and assistance for your children and/ or just the added expense of caring for the children whilst in your care.

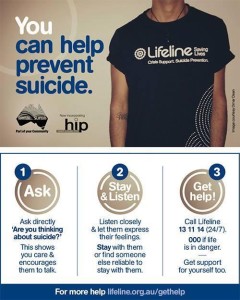

Don’t go it alone if you need help! Ask around and you will be surprised how much free help and assistance there is. There are lots of places you can go to get your finances sorted but the first step is to make a budget and workout your limits.

There was a study conducted not that long ago on post-separated fathering by The Australian Institute of Family Studies which found that men appeared to be generally ‘unaware of and unprepared for separation. This can mean that men do not approach their finances as an important factor in maintaining a positive parenting environment i.e. doing a budget will help you not spend more than you earn. This is critical for your health and well-being and this is important for your children.

The Australian Government has provided some great tools and resources to assist you with information that will help you through these life events such as separation and divorce. There is a great Budget Planner that helps you think about your money and looks at what is essential and what could be cut back if necessary to get you through this period.

If you feel you need urgent help to sort out your bills and prepare a budget, you can call 1800 007 007. This free hotline is open from 9.30am – 4pm Monday to Friday. When you call the number you will automatically be transferred to the phone service in your state where a financial counsellor will help you.

Bills are some of the biggest financial strains that people have to deal with week to week. Most people have to deal with more than a few different kinds of utility bills. The biggest problem people have with bills is the fact you cannot really do anything about them. You need your utilities so you need to pay your bills, but there are some methods to lower the amount you are paying week to week. These are the top three you can manage. Every method you take is money in your pocket. Money you need more than they do.

Bills are some of the biggest financial strains that people have to deal with week to week. Most people have to deal with more than a few different kinds of utility bills. The biggest problem people have with bills is the fact you cannot really do anything about them. You need your utilities so you need to pay your bills, but there are some methods to lower the amount you are paying week to week. These are the top three you can manage. Every method you take is money in your pocket. Money you need more than they do.  Every parent wants to do a good job raising their kids.

Every parent wants to do a good job raising their kids. People often associate negotiations with deals between companies or purchases but in reality, the average person makes dozens of negotiations every single day. Whether it’s discussion with an (ex)spouse, pleading with children, or coming to a consensus on dinner plans with friends – negotiating is a part of everyday life. While everyone inevitably engages in some form of negotiation, not everyone is skilled at it. Luckily, it doesn’t require years of business classes to become a great negotiator. And the benefits of becoming a great communicator can be tremendous. Keep the following things in mind for future negotiations.

People often associate negotiations with deals between companies or purchases but in reality, the average person makes dozens of negotiations every single day. Whether it’s discussion with an (ex)spouse, pleading with children, or coming to a consensus on dinner plans with friends – negotiating is a part of everyday life. While everyone inevitably engages in some form of negotiation, not everyone is skilled at it. Luckily, it doesn’t require years of business classes to become a great negotiator. And the benefits of becoming a great communicator can be tremendous. Keep the following things in mind for future negotiations. Stress and emotional pain of a separation can be exacerbated by worrying over expenses for your children. Let yourself focus on the important things in life, and work on discovering strategies that will help you to find workable solutions to your financial stress. Here are some tips on how to deal with your kids expenses when you’re separated.

Stress and emotional pain of a separation can be exacerbated by worrying over expenses for your children. Let yourself focus on the important things in life, and work on discovering strategies that will help you to find workable solutions to your financial stress. Here are some tips on how to deal with your kids expenses when you’re separated. Circumstances can change. We can’t assume the present needs of our children will be their future needs, you may not own the same assets in one year that you own in another, you might remarry, separate, divorce or anything.

Circumstances can change. We can’t assume the present needs of our children will be their future needs, you may not own the same assets in one year that you own in another, you might remarry, separate, divorce or anything. I needed to be completely honest with myself, I couldn’t hide debt and expect to have a budget that would work. So I added everything up and didn’t forget to add in the food, beer, petrol, iTunes downloads, books, movies and gifts for the kids. They are all legitimate and definite expenses for us dads.

I needed to be completely honest with myself, I couldn’t hide debt and expect to have a budget that would work. So I added everything up and didn’t forget to add in the food, beer, petrol, iTunes downloads, books, movies and gifts for the kids. They are all legitimate and definite expenses for us dads.

Recent comments