In the wake of separation, when emotions run high and uncertainties loom, one of the most critical aspects to address is financial stability. As a separated dad, mastering financial literacy becomes an essential skill that not only empowers you to navigate your new reality but also lays the foundation for a secure and prosperous future. Here’s a comprehensive guide to help you bolster your financial literacy and make informed decisions during this transformative phase.

1. Take Stock of Your Finances: Begin by conducting a thorough assessment of your financial situation. Create a detailed inventory of your assets, liabilities, income, and expenses. This clear snapshot will serve as a starting point for making informed financial choices.

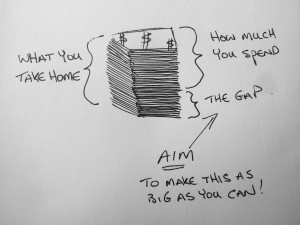

2. Develop a Budget: Crafting a budget is a fundamental step in managing your finances effectively. Outline your monthly income and allocate funds for essential expenses like housing, utilities, food, and transportation. This will help you gain control over your spending and ensure that you live within your means.

3. Prioritize Debt Management: Address any existing debts promptly. Identify high-interest obligations and create a strategy to pay them down efficiently. Minimizing debt can alleviate financial stress and free up resources for more crucial priorities.

4. Establish an Emergency Fund: Life is unpredictable, and having an emergency fund is your safety net in times of unexpected expenses or emergencies. Aim to save three to six months’ worth of living expenses in a separate account.

5. Understand Child Support : Familiarize yourself with the legal requirements and obligations regarding child support payments. Comply with court orders and ensure these responsibilities are factored into your budget.

6. Open Separate Financial Accounts: Establish individual bank accounts, credit cards, and other financial accounts to maintain autonomy and organization in your finances.

7. Update Legal and Financial Documents: Review and update legal documents such as your will, beneficiaries, and insurance policies to reflect your new circumstances accurately.

8. Seek Professional Financial Advice: Enlist the services of a certified financial planner or advisor with experience in divorce and separation. They can provide personalized guidance on managing assets, investments, and future financial goals.

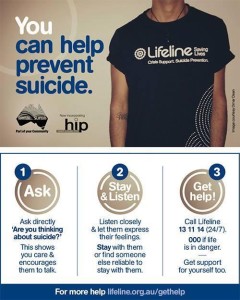

If you work for a corporation, check their EAP (Employee Assistance Program) most large organisations have one. They will have up to 6 free sessions with a financial adviser and it’s all confidential.

9. Plan for Retirement: Even during separation, it’s crucial to continue planning for your retirement. Contribute to retirement accounts if you can with salary sacrificing and maintain a long-term perspective on your financial well-being. That day will come and you’ll be glad you did!

10. Invest in Financial Literacy Education: Take advantage of workshops, seminars, and online resources to enhance your financial literacy. Understanding concepts like investing, taxes, and estate planning will empower you to make informed decisions. The Gov’t has a good website called “Money Smart”.. its a good place to start.

11. Explore Income-Generating Opportunities: Consider avenues to boost your income, such as pursuing additional education, training, or side hassles. Diversifying your income sources can provide greater financial stability.

12. Secure Adequate Insurance Coverage: Review your insurance policies, including health, life, and disability coverage. Ensure you have adequate protection for yourself and your dependents.

13. Involve Your Children: Teach your children about financial responsibility and involve them in age-appropriate discussions about budgeting, saving, and making thoughtful spending choices.

14. Embrace minimalistic and Smart Spending: As you adjust to your new financial reality, adopt a mindset of minimal. Cut unnecessary expenses, negotiate bills, and make conscious spending decisions. I hope you don’t have credit cards? If you do, cut them up. Call your bank and ask for a lower interest rate on your credit card, you’ll be surprised what you get if you ask. Then pay them off.

15. Plan for Future Goals: Set short- and long-term financial goals, whether it’s purchasing a home, funding your children’s education, or achieving a dream vacation. Developing a roadmap will help you stay focused and motivated.

Navigating the waters of financial smarts as a separated dad requires dedication, education, and a commitment to your future. By proactively managing your finances, seeking expert guidance, and making informed choices, you can build a solid financial foundation that not only supports you but also contributes to the well-being and stability of your family. Remember, every step you take towards financial empowerment brings you one step closer to a brighter and more secure future.

A great book that got my finances sorted was “The Barefoot Investor” (The only money guide you’ll ever need) and I recommend you buy it and adopt Scott Pape’s strategies.

Best Wishes

Dads Online

Recent comments