Spending more than you earn is the quickest way to get into financial stress, Lets say for example your take home pay is $4,000 a month but you actually spend $4,800. You ask how? Credit card debt, that’s how! Spending more than you earn is common & so easily done that you may not even realize your doing it until your credit card repayments start getting more than you can afford, and then you find yourself in financial trouble.

Spending more than you earn is the quickest way to get into financial stress, Lets say for example your take home pay is $4,000 a month but you actually spend $4,800. You ask how? Credit card debt, that’s how! Spending more than you earn is common & so easily done that you may not even realize your doing it until your credit card repayments start getting more than you can afford, and then you find yourself in financial trouble.

It can be very stressful at the end of the month when you try to divvy up your pay. You will have to put off what you can, go without, get an extension, part pay, run the petrol tank lean, go without lunch, eat the cupboard bear and often end up borrowing money to get you through to next pay packet.

The people that have been through this and survived know how important it is to “live within your means”. It usually only takes one bad experience of financial stress to never want to experience it again. It’s horrid, your whole world comes to a halt economically and you’re forced to have embarrassing conversations with telephone operators of utility companies, banks and landlords.

Some great financial tips to stop this happening are:

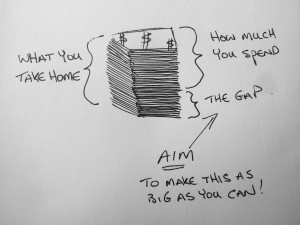

- Know how much you take home a month. Regardless of whether you’re paid weekly, fortnightly or monthly you can need to know what you take home in real dollars $. If your income is variable, look back over the last 6 months and calculate an average monthly take home pay.

- Know what your total monthly expenses are and know your debt. If you need a budget planner, here is one that I used and found it to be comprehensive, Click here for budget planner

- Know what you bottom line is. Subtract all your monthly financial commitments from your monthly take home pay and that is your bottom line. If you have money left over at the end of the month then you are “living within your means”. If you have no Gap then you must evaluate where you can make adjustments and reduce spending in non critical areas. Often you can workout needs versus wants.

- Know what your wants and needs are. It takes discipline and strength of character to put on hold your “wants”. For a while whilst you get under financial control, just go with what you need.

Getting back to a positive gap takes time but it is achievable, you get good at budgeting, good at saying “no” and believe it or not you do feel a sense of accomplishment. Its tough being frugal, no one likes it but if your in a position that you cant afford you will need to go through a little pain to get to pleasure by having your finances under control.

Comment